Are you looking to give your investment portfolio a boost? Well, have you ever considered diving into the world of construction stocks? With Malaysia’s ongoing and ambitious infrastructure projects, this might just be the right time to put your money where the bricks and mortar are. From highways sprouting up to towering skyscrapers reshaping our skyline, the construction sector is buzzing with activity. But is investing in these stocks a savvy move, or just another fleeting trend? Let’s dig deeper into why now might be the perfect moment to explore opportunities in construction stocks, and how they could become a solid bet for your financial future. Ready to break ground on your investment journey?

The Resurgence of the Construction Sector in a Post-Pandemic World

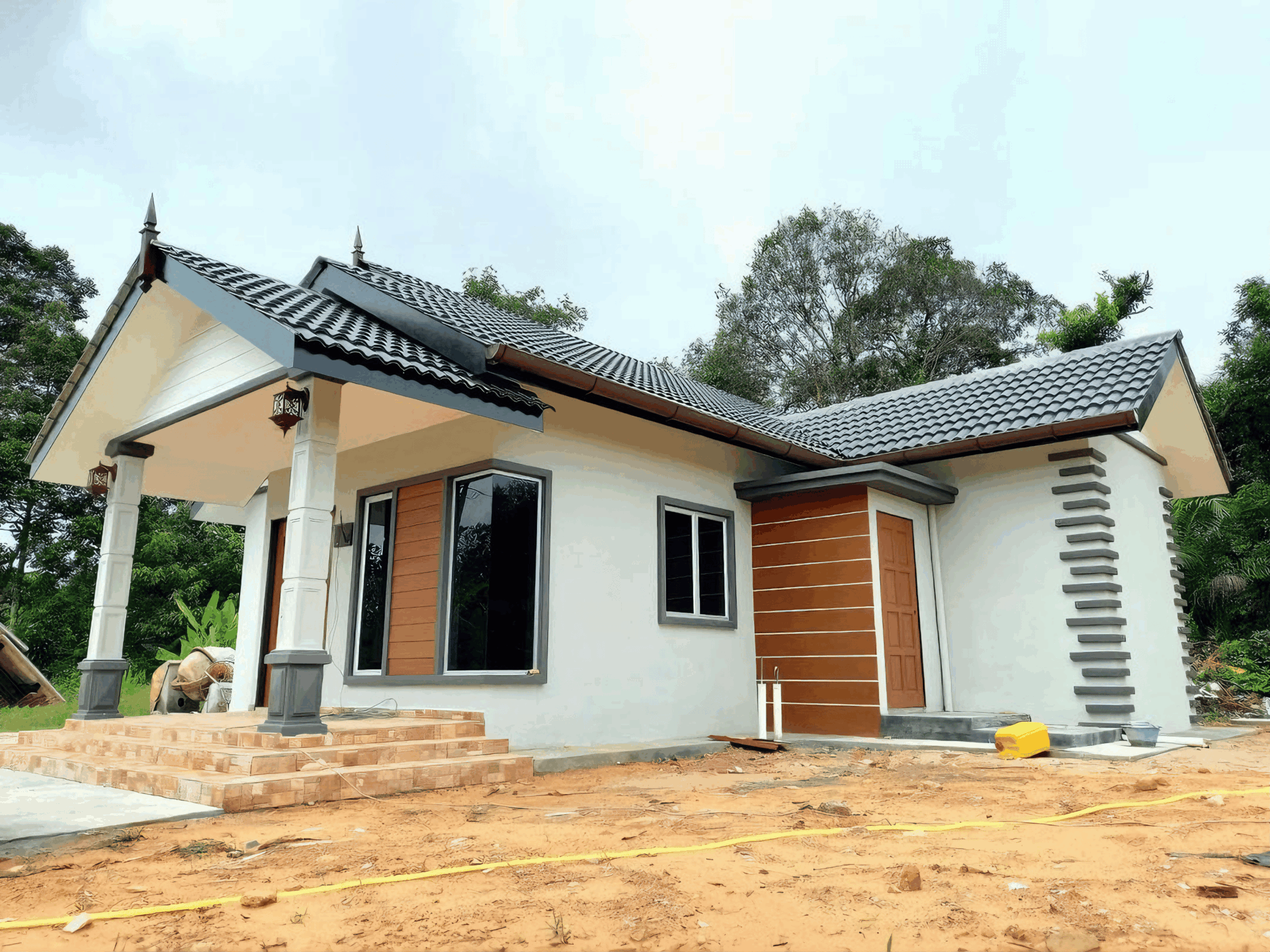

The construction sector is experiencing a remarkable revival as economies transition into a post-pandemic phase. With governments eager to stimulate growth, there’s a significant push towards infrastructure development and housing projects. In Malaysia, the government has launched several initiatives aimed at boosting the construction industry, creating a fertile ground for investments. As fiscal policies encourage more construction projects, investors have a unique opportunity to tap into this growing sector.

One of the key drivers fueling this renaissance is the increased demand for housing and commercial spaces. The pandemic has changed how we live and work, leading to urban migrations, a rise in remote working, and greater interest in sustainable living spaces. This shift implies a rising demand for new developments that meet contemporary needs. Investors can look at construction stocks as a strategic way to leverage these trends. Here are some factors to consider:

- Government Stimulus Packages: Financial support aimed at boosting infrastructure projects.

- Public-Private Partnerships: Increased collaboration between government and private entities for major projects.

- Innovations in Building Technologies: Adoption of green building materials and sustainability practices.

Additionally, it’s worth noting that construction stocks not only offer potential returns from project completions but also benefit from increased global supply chain activity. As trade routes reopen and demand rises, companies that supply materials and labor will see their stocks rise accordingly. Here’s a quick look at some key indicators:

| Indicator | Current Status | Future Outlook |

|---|---|---|

| Housing Starts | Up 15% | Expected to rise 20% in next year |

| Government Infrastructure Spend | RM 70 billion | Projected growth of 10% annually |

| Construction Material Prices | Moderate increase | Expected stabilization |

Identifying Key Drivers Behind Growing Demand for Infrastructure

The increasing need for better infrastructure is shaped by several interrelated factors that signal a lucrative opportunity for construction investments. Firstly, urbanization is moving at an unprecedented pace in Malaysia, with a booming population gravitating towards cities. This shift naturally necessitates enhanced facilities such as public transport networks, residential developments, and essential utilities. As more people settle in urban centers, the demand for seamless connectivity and modern amenities becomes vital, driving construction projects to the forefront.

Moreover, government initiatives play a crucial role in stimulating demand for infrastructure. Malaysia’s focus on economic development, through extensive policy frameworks and funding opportunities, has set the stage for a construction boom. Programs aimed at upgrading public transportation, enhancing road networks, and developing sustainable energy sources are in full swing. The government’s commitment to these projects highlights a conducive environment for investors, as robust funding mechanisms are often accompanied by private sector collaboration.

Lastly, the rising call for sustainable and resilient infrastructure cannot be ignored. With growing concerns over climate change and environmental sustainability, there’s a significant push towards green building practices and renewable energy solutions. Companies that adapt to these trends by investing in eco-friendly materials and technology are likely to reap the benefits. As consumers increasingly choose sustainable options, construction firms that incorporate these values into their projects will not only meet regulatory requirements but also enhance their marketability.

Spotlight on Innovative Technologies Shaping the Future of Construction

As the construction industry rapidly evolves, it’s hard to ignore the game-changing technologies that are reshaping the way projects are executed. From drones surveying landscapes to 3D printing entire structures, innovative solutions are not just enhancing productivity but also reducing costs. The rise of Building Information Modeling (BIM) allows for better collaboration among teams, improving accuracy when planning and constructing. This means investors can expect companies adopting these technologies to not just keep up, but to also lead the charge into a more efficient future.

Smart construction sites equipped with Internet of Things (IoT) devices are another exciting frontier. These technologies monitor everything from machinery performance to worker safety, thereby minimizing risks and ensuring projects remain on schedule. By investing in firms that prioritize smart tech, you can tap into the potential of increased profitability stemming from reduced downtime and waste. The buzz around augmented reality (AR) is also noteworthy, as it allows for real-time visualization and problem-solving throughout the construction process, making it easier to make adjustments before a single brick is laid.

Let’s take a moment to explore some of the transformative technologies currently making waves in the construction sector:

| Technology | Benefit |

|---|---|

| Drones | Aerial surveys and inspections for accuracy |

| 3D Printing | Rapid prototyping and cost-effective construction |

| BIM | Enhanced collaboration and project visualization |

| IoT | Real-time monitoring for safety and efficiency |

| AR | Improved design accuracy and stakeholder engagement |

Evaluating the Financial Health of Leading Construction Companies

When it comes to understanding the financial health of prominent construction firms, we need to look at several key indicators. First, revenue growth acts as a barometer for demand in the construction sector. Healthy year-on-year growth can signal that a company is not only keeping pace with the market but is also potentially expanding its reach and capabilities. Other metrics like net profit margin and return on equity help us gauge how efficiently a company manages its expenses and generates profit from its shareholders’ investments.

Additionally, the company’s balance sheet offers a clear view of its financial stability. A high current ratio indicates that a construction firm can easily cover its short-term liabilities, which is crucial in a project-driven industry that often faces cash flow fluctuations. It’s also important to monitor the debt-to-equity ratio; a balanced ratio suggests strong financial footing, while excessive debt may indicate potential future risks, especially during economic downturns.

| Company Name | Revenue Growth (%) | Net Profit Margin (%) | Current Ratio | Debt-to-Equity Ratio |

|---|---|---|---|---|

| ACME Construction | 15 | 10 | 2.5 | 0.4 |

| GreenBuild Corp | 12 | 8 | 3.0 | 0.5 |

| SteelWorks Ltd | 20 | 12 | 1.8 | 0.6 |

By keeping an eye on these financial metrics, investors can make informed decisions about which construction stocks to consider when looking to diversify their portfolios. It’s essential to analyze these numbers in conjunction with broader economic indicators, such as infrastructure spending and regulatory changes, to gain a comprehensive view of the sector’s potential growth.

Diversification Strategies: Balancing Risk in Construction Stock Portfolios

Diversification is not just a fancy term thrown around in investment circles; it’s a crucial strategy, especially when you’re diving into construction stocks. By spreading your investments across various sectors within the construction industry, you can mitigate risks associated with market volatility. Consider allocating your funds into different areas like infrastructure, residential, and commercial development. This way, if one sector takes a hit, the others might still flourish, keeping your overall portfolio more balanced.

Another smart move is to invest in both large-cap and small-cap construction companies. Large-cap firms often have a more stable performance due to their established presence and resources, while small-cap companies can offer impressive growth potential. By balancing your investments, you can enjoy the stability of big players while still aiming for high returns from up-and-coming businesses. Here’s a simple table to illustrate some potential investment areas:

| Company Type | Example | Potential Risks |

|---|---|---|

| Large-Cap | Gamuda Berhad | Market fluctuations, regulatory changes |

| Small-Cap | WCE Holdings Berhad | Liquidity issues, higher volatility |

Don’t forget about geographical diversification, too. Since the construction market can differ widely from one region to another, expanding your investments beyond Malaysia can bring additional stability. Look into regional construction firms in Southeast Asia as they can weather local economic downturns while capitalizing on growth in other areas. Whether it’s Indonesia’s booming infrastructure projects or Vietnam’s rapid urbanization, seeking opportunities outside your immediate market can create a more resilient investment approach.

Navigating Regulatory Changes that Impact Construction Investments

Keeping up with new laws and regulations is critical for anyone diving into construction investments. These changes can affect everything from project timelines to cost projections. Investors should stay alert and proactive, as different jurisdictions might introduce measures that can either boost or hinder growth. It’s essential to regularly review the following aspects:

- Permitting processes: Navigating through the permits needed for construction can be daunting. Updates in regulations can speed up or slow down processes.

- Safety regulations: New safety laws can increase operational costs but simultaneously improve project outcomes and worker safety.

- Environmental regulations: Compliance with sustainability measures can influence project feasibility and community support.

To further enhance understanding, it’s advantageous to watch how companies in the industry respond to these regulatory changes. Some may innovate and adapt swiftly to leverage new opportunities while others may find themselves lagging. A quick look at how a few construction firms are managing these challenges tells a broader story:

| Company | Regulatory Adaption | Impact on Performance |

|---|---|---|

| Firm A | Implemented new safety measures ahead of schedule | Increased worker productivity and reduced delays |

| Firm B | Invested in green building certifications | Attracted eco-conscious clients and partners |

| Firm C | Streamlined permitting through digital tools | Faster turnaround on projects and cost savings |

Long-Term Trends: Sustainability and Green Building Initiatives

As the world awakens to the urgent need for environmental consciousness, an undeniable shift is occurring in the construction industry. Sustainability is not just a buzzword; it’s becoming the cornerstone of building practices. Developers are increasingly opting for eco-friendly materials, which not only reduce the carbon footprint but also enhance the aesthetic appeal of properties. Expect to see innovative designs that incorporate renewable energy sources, water-efficient systems, and recycling initiatives that appeal to the eco-savvy Malaysian consumer.

Government policies in Malaysia are also lending a hand, encouraging both private and public sectors to adopt green building practices. Incentives for energy-efficient buildings and smart city developments are on the rise, making it an attractive terrain for investors. As the public grows more aware of climate-related issues, they increasingly demand properties that align with their values. As a result, the market is witnessing a boom in demand for sustainable housing, commercial spaces, and infrastructure, creating a promising environment for construction stocks.

Moreover, investing in this sector offers the potential for long-term financial gains. Companies leading the charge in sustainable development are likely to emerge as frontrunners. Consider some key factors:

| Factor | Impact on Investment |

|---|---|

| Government Incentives | Boosts profitability and lowers operational costs |

| Growing Eco-consciousness | Increases market demand for green projects |

| Technological Advancements | Improves efficiencies and reduces waste |

as the focus on sustainability intensifies, keep an eye on construction stocks that champion eco-friendly initiatives. Investing in companies that prioritize these practices can lead to both a healthier planet and a healthy portfolio.

Expert Insights: Recommendations for Smart Investments in Construction Stocks

When diving into construction stocks, it’s essential to prioritize companies that show strong fundamentals and resilience in the face of market fluctuations. Look for firms with robust balance sheets and a history of adaptability. Some key indicators to consider are:

- Revenue Growth: Steady year-over-year revenue increases can point to effective management and market demand.

- Profit Margins: Companies with high and improving profit margins can often weather economic storms better.

- Debt Levels: A manageable level of debt relative to equity is crucial for long-term stability.

Additionally, keep an eye on the sectors within the construction industry. The green building movement is gaining traction, and companies focused on sustainable practices are likely to see growth. Look for stocks that are investing in:

- Renewable Energy Projects: Companies pivoting towards solar and wind energy can provide long-term growth potential.

- Smart Technology Integration: Firms that incorporate tech solutions like IoT in construction processes tend to be ahead of the curve.

- Infrastructure Development: Governments around the world, including Malaysia, are investing heavily in infrastructure, benefiting construction companies significantly.

Lastly, don’t neglect the importance of tracking geographical performance. Emerging markets in Southeast Asia, particularly Malaysia, are ripe for investment. Analyzing construction firms operating in regions with planned developments or public-private partnerships can reveal promising opportunities. When evaluating options, consider creating a comparison table of potential investments that highlights:

| Company Name | Market Cap | Growth Rate (%) | Sustainability Focus |

|---|---|---|---|

| XYZ Construction | RM 500M | 12 | Yes |

| ABC Builders | RM 300M | 8 | No |

| GreenFuture Corp. | RM 800M | 15 | Yes |

Closing Remarks

As we wrap up our exploration of why investing in construction stocks might just be the cleverest play you make right now, let’s take a moment to reflect. The construction sector is buzzing with potential, especially in our ever-growing Malaysian market. Whether it’s infrastructure projects sprouting up or new residential developments in the pipeline, there’s plenty for investors to dig into.

Of course, every investment comes with its risks, and it’s crucial to stay informed and keep an eye on market trends. But with the right approach, riding the wave of construction stocks can lead to rewarding outcomes. So, as you mull over your next investment move, consider adding a sprinkle of construction to your portfolio. After all, building your financial future could be as straightforward as jumping on board with this thriving industry.

Happy investing, and may your portfolio grow as solidly as the structures rising around us!

Source link

kontraktor rumah

bina rumah

pinjaman lppsa

pengeluaran kwsp

spesifikasi rumah

rumah batu-bata

pelan rumah

rekabentuk rumah

bina rumah atas tanah sendiri

kontraktor rumah selangor

rumah banglo